Add or update VAT-ID

In case your business is registered for VAT in the European Union, you have the option to include your VAT-ID number in your account. By doing so, you will not be charged value-added tax (VAT) on your product or subscription.

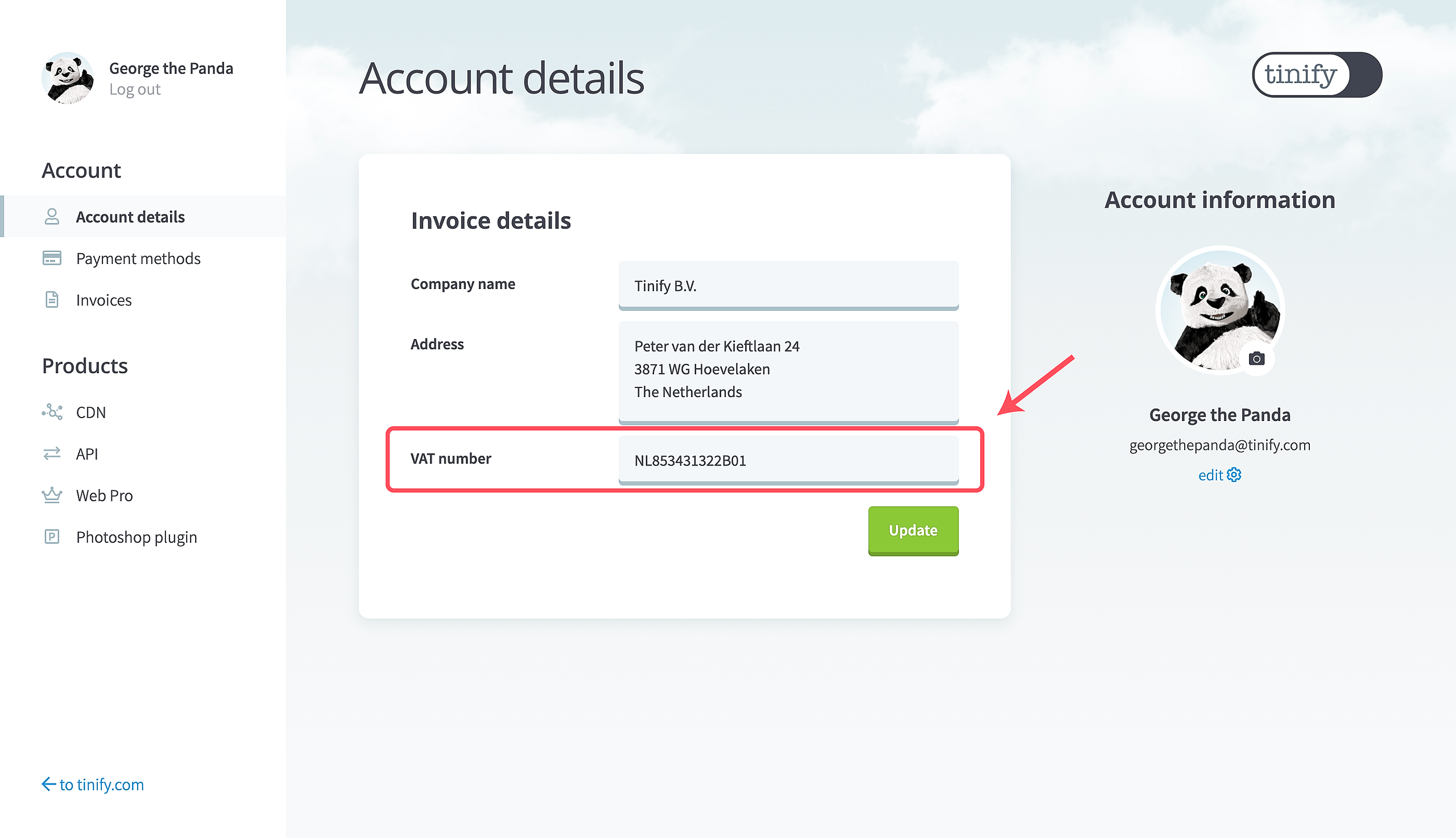

Your EU VAT ID should consist of a country prefix, such as DE for Germany, followed by your company's local tax ID number. It's important to note that the VAT ID must not contain any spaces or special characters.

Please note: if you modify a VAT-ID, any tax rate changes will only apply to forthcoming invoices. Please be advised that changing VAT-ID numbers on existing invoices is not feasible.

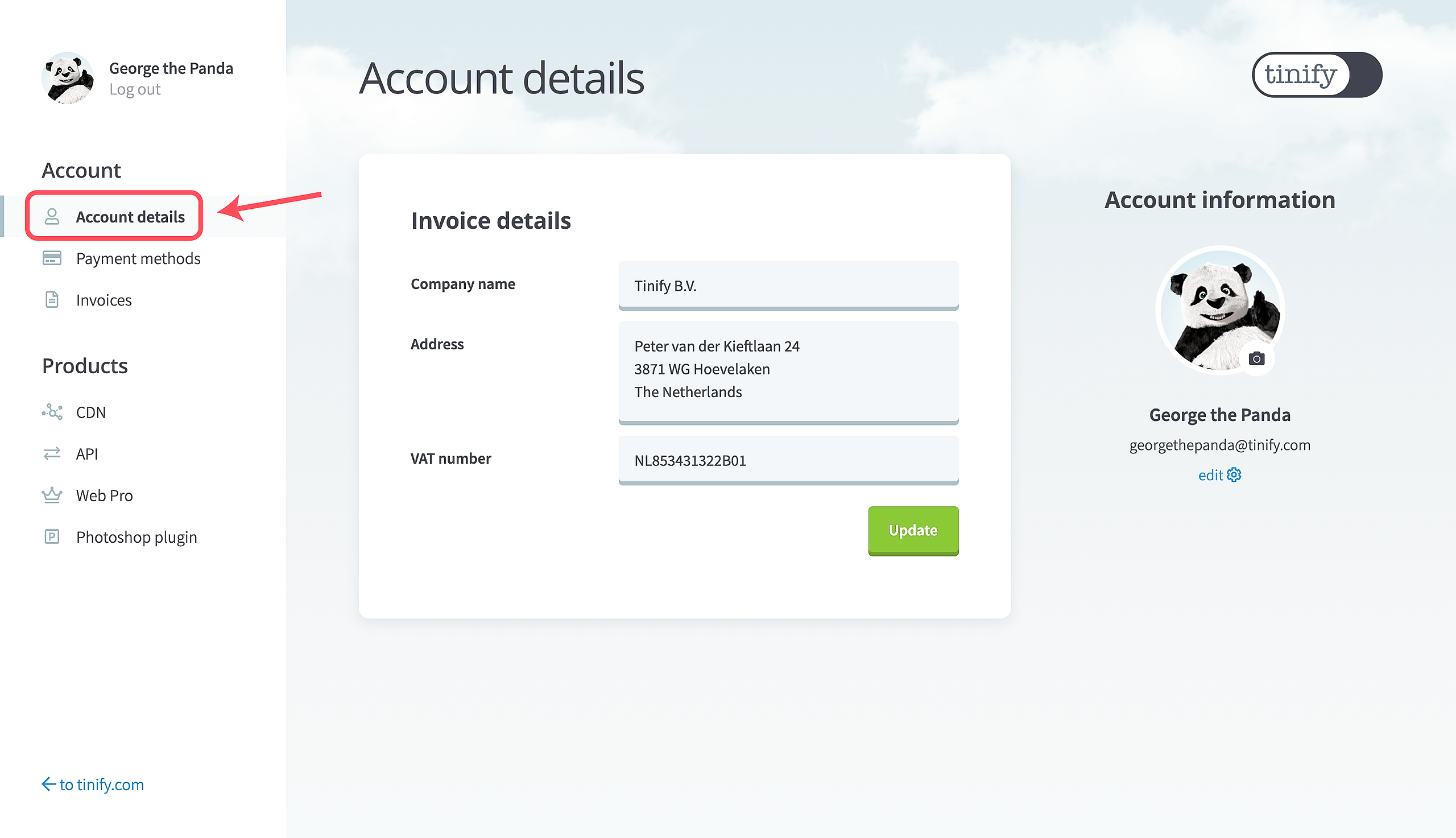

- Log in to view your account dashboard.

- In the dashboard menu, select Account details or go to https://tinify.com/dashboard/account-details

- You can enter or edit the VAT-ID (future invoices only).

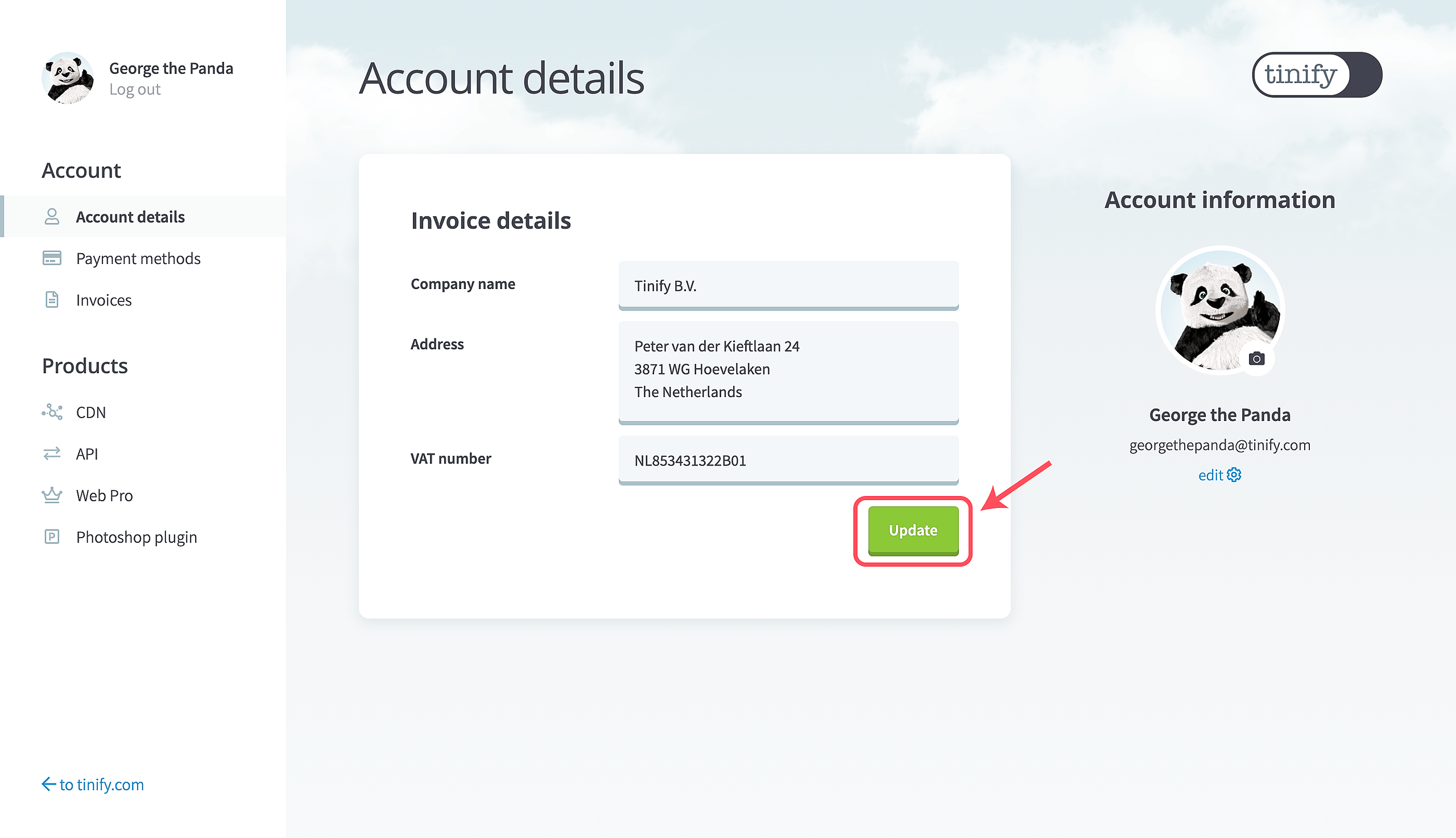

- Click or tap Update.